How to Decipher Your Paycheck: A Guide for Nurses

Let’s talk about something that might seem a bit intimidating but is crucial for your financial wellness—your paystub. If you’re like many people, the words and abbreviations on your paystub might feel like a foreign language. Don’t worry; you’re not alone! I’m here to help you understand what all those numbers and terms really mean.

Why Check Your Pay SLIP?

Okay, so let’s start with the golden rule: always check your paystub. You might be thinking, “It looks the same each time, so why bother?” Well, let me tell you a story: one nurse I know never checked hers until she found out there had been a small deduction error that added up over the year. Oops! The lesson here? Employers do their best, but mistakes can happen.

Think of your paystub is another critical part of your well-being. Just like you wouldn’t skip your annual checkup, give your paystub the attention it deserves. After all, you’ve worked hard for every penny. Let’s make sure you’re getting them!

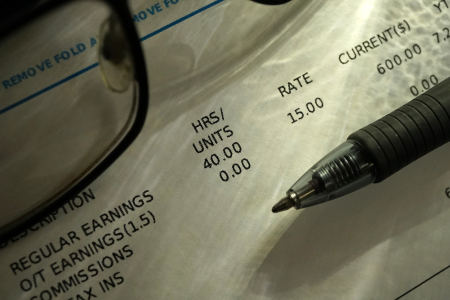

Decoding Your Paystub

Ok, time to into the nitty-gritty of that paystub. I promise, it’s easier than it looks once you know what everything means.

Gross Pay

Picture your gross pay as the grand total of what you earn before Uncle Sam takes his share. It’s like looking at a price tag before taxes. Here’s where you’ll see your base salary, overtime, and any bonuses. It gives you a baseline to understand your earning potential each period.

Let’s say you volunteered for overtime last month—woohoo for extra earnings! Be sure this reflects accurately in your gross pay. It’s your hard work; let’s see those hours come through!

Net Pay

Here’s what really counts—net pay. This is the remaining of what hits your account after all deductions. Think of it as your “take-home” amount, the real-world money that pays the bills, buys groceries, or maybe splurges on a thing or two.

Pre-Tax Deductions

Pre-tax deductions are your best friends for lowering taxable income. When you contribute to your 401(k) or pay for health insurance, these are deducted before taxes, reducing your taxable income. It’s a smart move for saving money now and later in retirement funds.

Imagine stowing a bit away each paycheck—come tax time, you’ll have minimized your taxes while increasing your savings! It’s a win-win.

Taxes

Ah, taxes—the inevitable, unavoidable slices of your pie that go to federal, state, and sometimes local governments. This also includes Social Security and Medicare, the programs that set you up for future benefits. Sure, it might sting a bit, but it’s important for supporting those big-picture infrastructures.

Remember, this is how we collectively fund things like roads and schools. Think of taxes as a way of future-proofing your country’s infrastructure, paving for a smoother ride down life’s highway.

Post-tax deductions

These come into play after your taxes have been calculated. They can include things like Roth IRA contributions or union dues. Since these are subtracted from your net pay, they don’t help with lowering current taxable income, but they can provide benefits like tax-free growth later on.

Employer contributions

Love it when you see those extra contributions from your employer? I bet you do! These typically relate to matching contributions to your retirement fund. Employer contributions are an important yet sometimes underrated part of your paycheck but can substantially boost your total compensation and savings.

Retirement Contributions: Many employers match a portion of your contributions to retirement plans like a 401(k). For example, if you contribute 5% of your salary, your employer might match 50% up to a certain limit. Over time, this can be a nice addition to your retirement savings.

Health Savings Accounts Contributions: Employers might add funds directly to your HSA, which can reduce your out-of-pocket health costs. This additional support is super helpful for managing health expenses now and in the future.

YTD (Yea-to-Date)

YTD amounts help track what you’ve earned and paid over the course of the year. Have a peek at the YTD column to see if everything matches up with what you expected. This is especially handy if you’re planning for future financial goals like buying a house or launching that dream vacay.

Shift Differentials and Special Pay

Given the unpredictable hours and high demands in nursing, many healthcare facilities offer shift differentials—additional pay for night shifts or weekends. Specialty pay for certifications or specific duties (such as a charge nurse role) or having a Bachelor’s Degree should also be noted here. Make sure these adjustments appear on your paystub.

PTO and Accruals

Your paystub often tracks accrued PTO. Any time-off policies around sick leave, vacation, or personal days will be reflected here. This section helps make sure you aren’t overpaid or under-allocated time-off days, pay close attention to this. Because I don’t know about you but I will NOT be shorted on my PTO.

Overtime

If you’re a staff nurse you might be working overtime due to the demands of the job. It’s vital that your overtime is calculated correctly—typically at 1.5 times your normal rate, though laws and agreements can affect this. Make sure the hours align with your records and match what you’ve worked.

Bottom Line to Figuring Out Your Paystub

Taking a few minutes to check your paystub can make a big difference. It’s not just about making sure you’re paid correctly for the hours you worked; it’s also about keeping track of your accrued sick time, PTO, and retirement contributions. Whether you’re checking for regular time, overtime, or holiday pay, accuracy is key to your financial progress.

So next time you get your paystub, take a moment to look it over. Advocate for yourself just like you advocate for your patients. Your financial wellness is just as important. Keep an eye out, and don’t hesitate to reach out to HR or payroll if something doesn’t look right. You’ve earned it!

Related Articles

- 16 Key Financial Terms Every Nurse Should Know

- Lifestyle Inflation: 10 Clear Signs You May be a Victim

- 3 Reasons Why Nurses Splurge on Expensive Cars